НОВОСТИ

Analysis of The Market Trend

Время выпуска:

2020-09-30 14:13

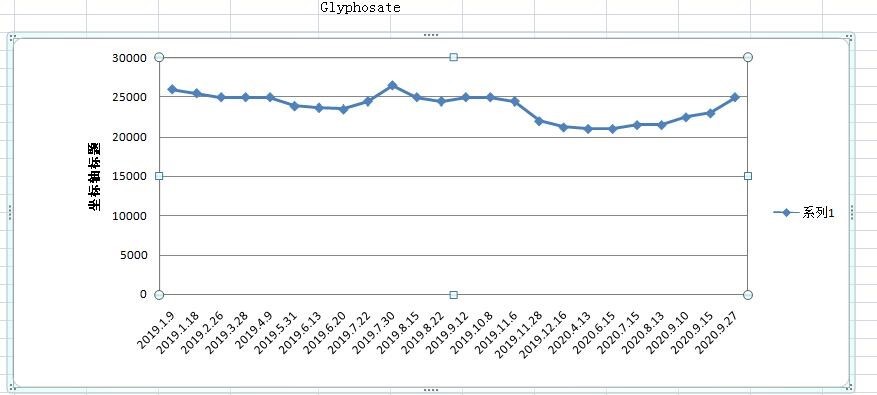

1.Glyphosate

From January to August this year, the production capacity of glyphosate in China was about 360,000 tons, down 9.2% year-on-year. The current stock of glyphosate technical is low, Each factory orders delivery mainly, Fuhua and Hebang, affected by the flood in Sichuan, have not yet finished their periodic shutdowns and resumed production. Wynca and Guangxin shutdown overhaul and return to work not for a long time, low capacity utilization, cut supplies, each manufacturer quotation sheet carefully, prices, market awareness is high, For the next situation, the opinions differ from each other, most manufacturers think that cut supplies superposition the peak season of consumption, bullish on glyphosate prices continue to steadily upward, but the early stockpiling traders shipping at low prices.

Expectation: This wave of glyphosate price rise is felt to be mainly due to a significant reduction in supply rather than real demand strength, the momentum for further rise is insufficient, but tensions will remain high until November.

2.Glufosinate ammonium

Supply is still tight, but market expectations were so-so, slowing demand.

Expectation: The price will fall steadily in October without any upward momentum.

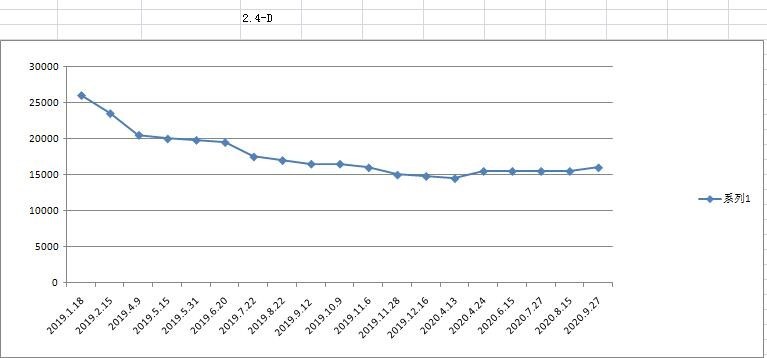

3.2,4-D

CAC group, the main manufacturer, has suspended receiving orders. There are too many orders. The original medicine orders have been received in November, and the overall supply of the market is tight.

Expectation: The supply will remain tight in October and the price will be high.

4.Clethodim

Production capacity of original medicine is enough, Intermediate supply is normal. Export oriented.

Expectation: Competition intensifies and futures prices will continue to decline

5.Quinclorac

Low start-up rate of manufacturers, low inventory, tight supply.

Expectation: October will maintain tight supply and stable price situation.

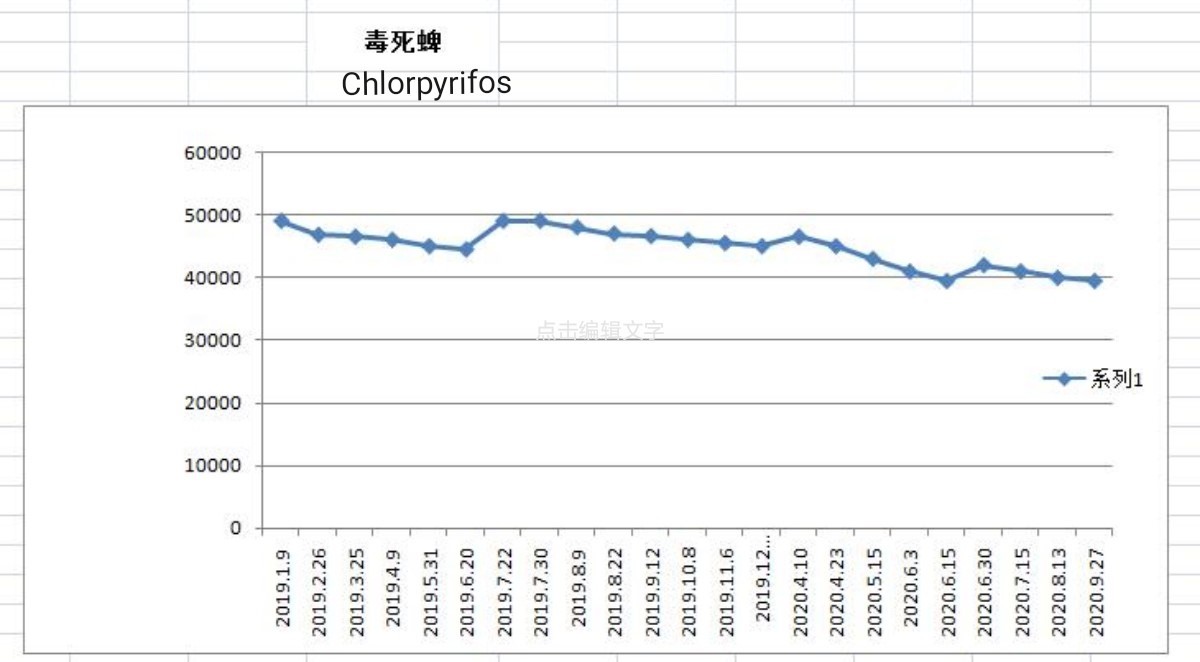

6.Chlorpyrifos

Export orders are low and the market is in a slow season. Export volume has declined due to the impact of foreign epidemic situation and the increase of countries that have banned chlorpyrifos.

Expectation: the demand is not strong, we will pay close attention to the price adjustment strategy of the factory, and it will remain stable in October. The firm orders can be discussed.

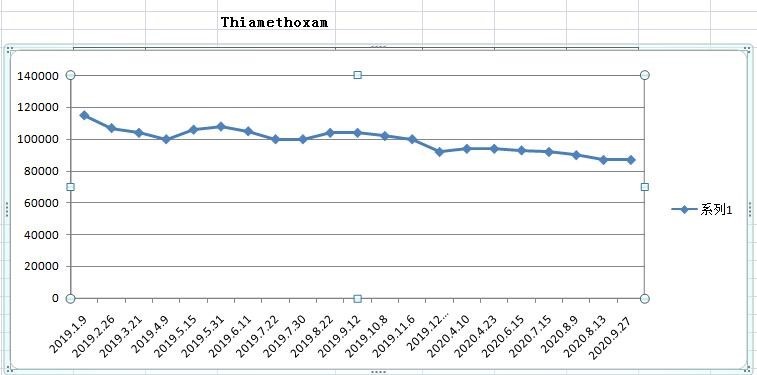

7.Thiamethoxam

The supply of goods in the market is stable and the market is off season. Ruitian Hebei in the maintenance and expected to resume at the end of September. De-rich plans to shut down for maintenance on September 25, which will take about 25 days and reduction of initiative on the supply side.

Expectation: market price close to cost, price will be relatively stable in October.

8.Imidacloprid Acetamiprid

Due to low exports, high inventories, neonicotinoid technical low prices, upstream intermediate prices are also in the correction. The imidacloprid technical market is still in stock. Acetamiprid technical also remained in decline. Hailir maintenance will continue until October, the market is weak, the factory maintenance schedule is longer than in previous years. In addition, the main raw materials of imidacloprid, including 2-chloro-5-(chloromethyl)pyridine and imidazolidine, are at a low level. With the addition of labor costs, depreciation of hydropower equipment, packaging and other costs, the current price has been near the cost line.

Expectation: close to the cost line, October will be relatively stable, the actual transaction can be discussed.

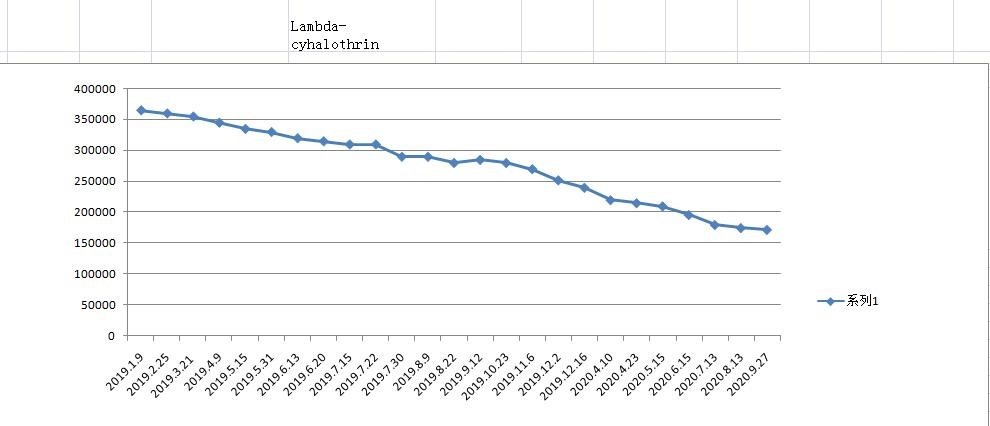

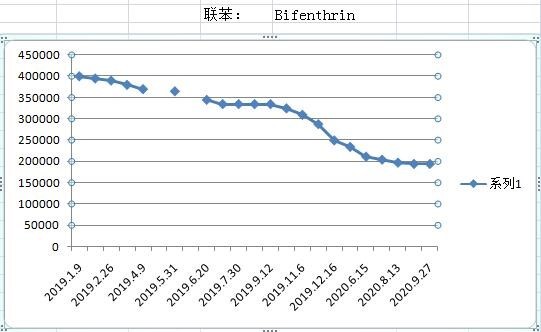

9.Lambda cyhalothrin Bifenthrin

The upstream intermediate 3-Phenoxybenzaldehyde is still affected by the epidemic situation in India, and the import is difficult, but the market demand is moderate, which leads to the continuous decline of pyrethroid products and upstream raw material prices.The demand for cyhalothrin slows down, the inventory increases. The operating rate of bifenthrin technical was improved.

Expectation: will continue to steady downward.

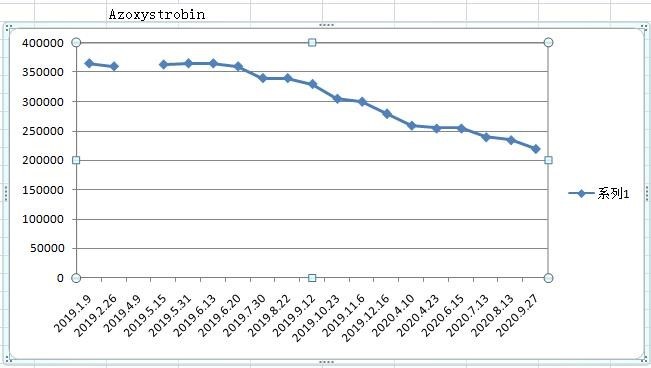

10.Azoxystrobin

Market inventory increase, stable supply, firm orders can be discussed.

Expectation: demand is insufficient, price falls steadily.

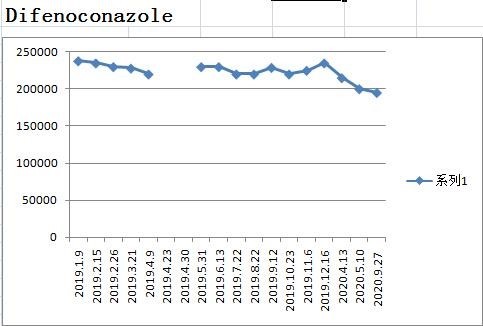

11.Difenoconazole

Difenoconazole start normal, stable supply of goods in the market, the actual transaction can be discussed.

Expectation: Prices will continue to fall in October.

12.Pyraclostrobin

Manufacturers' operating rate is increasing, supply is increasing, and demand is relatively low. All manufacturers are facing competitive pressure.

Expectation: October will remain relatively stable.

13.Tebuconazole

Because markets in eastern Europe, there are some large customers order, lead to goods suddenly in short supply. Seven Continent, Huanghai have stopped quotation. At present several tebuconazole technical factory didn't order, the order was to December, the overall lack of confidence in the market, mainly wait-and-see, basic shutdown small manufacturer, the price decline slowed. Intermediate material p - chlorobenzaldehyde price rebound, market quotation rise, delivery trend, some factory futures orders cheap. Intermediate material p - chlorobenzaldehyde price rebound, market quotation rise, delivery trend, some factory futures orders cheap; Limin Yancheng will start production of tebuconazole in mid-to-late October.

Expectation: the current trend, the factory pull up intention is obvious, estimated in October will be stable in a small rise.

14.Prochloraz

Stable supply, market demand into the off-season, weak demand, intensified competition, the actual transaction can be discussed.

Expectation: October will continue to slow down.

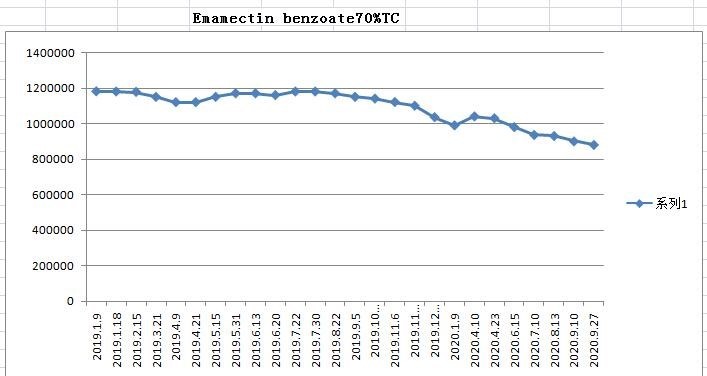

15.Abermectin Emamectin Benzoate

The market of abermectin is relatively stable. The market of emamectin benzoate technical is affected by the export downturn, the price is in low level.

Expectation: October will be relatively stable.

Предыдущий

Следующий

Предыдущий

Следующий

LANGUAGE

LANGUAGE